Please do not reply to this Newsletter. You will likely get a response from a machine, not Nancy! For

feedback on the Newsletter or to correspond with Nancy, click here instead.

Plague of Frogs

Frogs were on the move prior to the recent devastating quake in China.

Frogs Swarmed in China Before the Quake--Now It's California

May 18, 2008

http://observers.france24.com/en/content/20080513-toads-predict-earthquake-dead-china

- In the days prior to the gigantic earthquake that devastated Sichuan province in China,

odd swarms of frogs were seen in the streets of cities in the area, and have subsequently

been identified as unusual animal behavior of the type that is thought by some geologists to

precede earthquakes. Now it has developed that similar frog appearances have been

taking place in Bakersfield, California for about two weeks, and nobody is sure why.

Strange swarms of frogs also appeared before the 6.9 Loma Prieta Earthquake in October

of 1989.

There is historical precedence for nervous and restless frogs as earthquake predictors. In fact, a plague

of frogs was one of the plagues that struck Egypt prior to the Jewish Exodus. Where the Jewish Exodus

and the travails of Moses as he and the Israelites wandered in the desert for 40 years is most often

described in Biblical terms, it was in fact the most recent passage of Planet X approximately 3,600 years

ago. The plagues of Egypt describe the red dust from the tail of Planet X giving ponds and rivers a blood

red color and bitter taste; frogs and insects on the move; drought; depressed immune systems; hail;

volcanic gloom and darkness; and disease spread by opportunistic rats and insects. How many of those

problems exist in our world today, as we head into the next pass-by of Planet X?

- Plagues of Egypt

http://en.wikipedia.org/wiki/Plagues_of_Egypt

- The plagues as they appear in the Bible are:

1. (Exodus 7:14-25) rivers and other water sources turned to blood killing all fish and

other water life. (Dam)

2. (Exodus 7:26-8:11) amphibians (commonly believed to be frogs) (Tsfardeia)

3. (Exodus 8:12-15) lice or gnats (Kinim)

4. (Exodus 8:16-28) flies or beasts (Arov)

5. (Exodus 9:1-7) disease on livestock (Dever)

6. (Exodus 9:8-12) unhealable boils (Shkhin)

7. (Exodus 9:13-35) hail mixed with fire (Barad)

8. (Exodus 10:1-20) locusts (Arbeh)

9. (Exodus 10:21-29) darkness (Choshech)

10. (Exodus 11:1-12:36) death of the first-born of all Egyptian families. (Makat Bechorot)

Why were the frogs on the move? Per the Zetas, animals allow themselves to react to what they sense

from stressed rock - emanations coming from rock under pressure.

ZetaTalk Explanation 9/21/2004: Animals who give heed to what they sense from the ground,

unlike man who is asked to deny his senses and hunches, know these particle flows are exploding

in bursts ahead of quakes, and in those cultures where common sense prevails, this is

acknowledged to mean that pending quakes or certainly the likelihood of quakes as the ground is

under pressure, exists.

ZetaTalk Explanation 1/12/2008: When an animal senses the rock about them is stressed they get

an uncontrollable urge to flee.

Quake Predictors

Sensitive animals are not the only means of detecting the emanations coming from rock under pressure.

Static on radios is another indication, and is known to precede earthquakes.

- Broadcast Warning, in Scientific American

March, 1990

- Witnesses have also recalled lightninglike flashes emanating from the earth during quakes

and poor radio reception beforehand.

-

- Radio Loma Prieta, in Discover

May, 1990

- Fraser-Smith, a physicist at Stanford, has a contract from the Navy to monitor very-low

frequency radio waves (less than 10 hertz). In mid-September the airwaves around

Corralitos[, California, 70 miles south of San Francisco,] started getting noisier, and on

October 5, Fraser-Smith's antenna suddenly recorded a 20-to-30-fold jump in the signal

below one hertz. In the following days the signal gradually declined, until by October 17 it

was down to five times the normal background level. That afternoon it soared again, this

time to 200 times the normal intensity. Three hours later a massive earthquake struck the

San Francisco area. This epicenter was in Loma Prieta, four miles from Corralitos.

-

- Electrical Clues Precede Some Tremors, in Science News

December 18, 1994

- Anthony Fraser-Smith of Stanford University in Palo Alto, California got into the

earthquake business by chance after one of his machines detected an unusual magnetic

disturbance before the Loma Prieta earthquake in October 1989. He has since set up five

of these instruments at key sites along the San Andreas fault, waiting to see whether

similar magnetic signals precede another quake. Stanford's Simon L. Klemperer and an

Israeli colleague have devised a theoretical model that could explain what Fraser-Smith

observed in 1989. They suggest that movement of the earth before a quake causes tiny

water-filled pores in the rock to connect, thus enabling an electrical current to flow.

The Zetas agree that what they call "emergent electrostatic screeches" are a key to predicting

earthquakes, and recommend that humans wanting to be forewarned start measuring this emanation from

the rock beneath them.

ZetaTalk Suggestions 7/15/1995: The frequency of what is termed emergent electrostatic

screeches, a sound which can be detected by sensitive humans, and much more accurately by

sensitive instruments. We are speaking here of bursts of electrical energy, which is invariably

accompanied by other types of energy so that any number of them can be measured. This should

be weighted in a bell curve manner, so that every increase in frequency weighs in more and more

severely.

A Troubled Times TOPIC has been established to this end in the companion website to ZetaTalk.

- TOPIC: Quake Prediction

- Radio interference is a predictor, so your car radio can act as your personal predictor, a

self-help point geo-monitor stresses. Signals between 3.8 to 4.0 Hz were registered before

the Northridge and Landers quakes, and many electro-magnetic pulse papers attest to the

reality of this detection technique. A Scientific American article describes how to build a

detector device or a Lehman's or backyard seismograph. A Troubled Times TEAM has

been formed to experiment with quake prediction.

Price of Oil

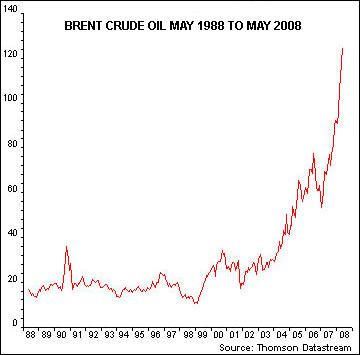

The price of a barrel of oil keeps rising, up to $135 a barrel on May 22, 2008 per the Drudge Report.

- Oil Climbs to Record Above $135

May 22, 2008

http://apnews.myway.com/article/20080522/D90QK2606.html

- Oil prices hit a record above $135 a barrel before falling back in Asia Thursday, with

supply worries, rising global demand and a slumping dollar keeping crude futures on an

upward track.

Recently Vice President Cheney visited the Middle East and talked to the Saudis about the price of oil.

This changed nothing. Can Bush do better? The Bush persona has a long-standing, ostensibly

affectionate, relationship with the Saudis, and the Bush administration has arranged to sell armaments to

the Saudis.

- US-Saudi Oil Axis Faces Day of Truth

May 16, 2008

http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2008/05/15/bcnoil115.xml

- When President George Bush went to see Saudi Arabia's King Abdullah in January to plead

for higher oil output, he was politely rebuffed. President Bush shared a laugh with Saudi

Prince Salman, brother of Saudi King Abdullah, but the rematch today is likely to be a

great deal more strained. If the Saudis deny help once again, they risk incalculable damage

to their strategic alliance with Washington. The price of crude has rocketed by over $30 a

barrel since that last fruitless meeting, briefly touching the once unthinkable level of $127.

Asked what he would tell King Abdullah this time, Mr Bush said caustically: "the price is

even higher." Indeed, it is, especially the political price.

Saudi Arabia's one saving grace -- in the eyes of US critics -- is that it has over the years

been willing to cap extreme surges in the price of oil, deploying its power as the world's

swing producer. This time Riyadh is giving no ground. Oil minister Ali al-Naimi insists that

there is plenty of oil about, blaming the latest spike on "the internal logic of the financial

markets", meaning hedge funds and speculators. The US Congress gave its riposte this

week. New York Senator Charles Schumer is pushing for sanctions against Saudi Arabia,

targeting $1.4bn in sales of bomb kits, light armoured vehicles, as well as gear for AWACS

aircraft and F-15 fighters. There have been calls for a food blockade of the Arabian

peninsular on the US talk radio circuit. "Let them eat sand", has been the rallying cry of

the shock-jocks. OPEC has -- in effect -- cut production repeatedly. The Saudis have let

their output fall from 9.5m to 8.5m bpd over the last two years.

But following the most recent Bush trip to the Middle East, with a pointed meeting with the Saudis, the

price of oil went up!

- Oil leaps After Bush's Saudi Trip

May 16, 2008

http://www.telegraph.co.uk/money/main.jhtml?

- The price of oil soared to yet another record high as President George W. Bush's second

trip to Saudi Arabia in four months appeared to deliver a token victory in the battle for

increased oil output. In New York, oil for June delivery touched a new high of $127.82 a

barrel, spurred by investment bank Goldman Sachs predicting an average price per barrel

of $141 in the latter half of the year. Early indications from President Bush's meeting with

King Abdullah of Saudi Arabia suggested he received largely the same reception as on his

visit in January.

Per the Zetas, the inability of Cheney and Bush to get the Saudis to pump more oil or arrange for a

lower price for US oil companies is directly related to the poor standing the US holds in the eyes of the

world.

ZetaTalk Insight 5/10/2008: The rise in the price of oil has exceeded the rate in the drop of the

dollar, so something else is afoot. Some of this price change merely reflects supply and demand,

as countries such as China are bidding for oil these days, as they are raising the standard of

living for their citizens. Another factor is that the US has always had a favorable price set for

their oil by OPEC, because of the roles they have played as the world's peacekeeper and the

keeper of the dollar, the world's standard currency in the past. When the US was keeping

Saddam at bay, and intervening in Bosnia, for instance, this was looked upon favorably. Now

that the US is borrowing funds from China, and is in essence a bankrupt nation, all so the Bush

administration could invade Iraq and made a mess of it for no reason, public opinion has

changed. Thus, the creep in the price of oil as set by OPEC for the US is a reflection of the poor

regard the Arab nations have for the US. Cheney attempted to change this new attitude recently

during a trip to the Middle East. The fact that the price of oil in the US has continued to

skyrocket shows his diminished stature in the eyes of OPEC members.

The price of oil just keeps going up and up! Who controls this? In part, oil speculators, who see demand

rising while the supply holds steady.

- Oil Sets Record Near $128; Pump Price at High, Too

May 16, 2008

http://biz.yahoo.com/ap/080516/oil_prices.html?.v=13

- News that Saudi Arabia had boosted its oil output by 300,000 barrels a day was greeted as

a non-event on oil markets -- the move wasn't anywhere near the kind of production

increase needed to bring prices down. And traders were equally unimpressed by the U.S.

government's plan to stop adding to the Strategic Petroleum Reserve. The response in the

oil trading pits? Traders did what they've been doing for months now, and pushed crude oil

and gasoline futures to new highs. The price for a barrel of benchmark light, sweet crude

for June delivery jumped $2.17 to settle at record close of $126.29 on the New York

Mercantile Exchange. Earlier in the session, prices surged to $127.82 a barrel, also a new

high. It was the eighth time in the past 10 sessions traders rewrote the record books, and

the first time prices topped $127 a barrel.

Per the Zetas, the price of oil has two fronts. One is competition for oil from China and other developing

countries and the resentment many oil producing countries have toward the US for their invasion of Iraq

and attempts to dominate the Middle East oil producing countries. The other is the dropping dollar. The

dollar now buys less in imported goods than it did in the past, as relative to the price of these imported

goods, the dollar is worth less. Seeing this trend of a dropping dollar, the oil producing countries have

begun to exchange their oil for currencies other than the dollar. The Bush administration has viewed this

as an extreme threat, as freed from being used as the international currency for oil, the dollar is likely to

drop faster and further.

ZetaTalk View 12/8/2007: Most oil producers have already switched to allow other than the

dollar in exchange for their crude, but in that the dollar was included in the mix and is

historically the medium of exchange for oil, this was not considered devastating to the dollar. It

is avoiding the dollar altogether that the US fears, as then those holding dollars will decide they

need not do this, and will begin seriously dumping the dropping dollar. This has been a steady

trend, with Iran's posture only another notch in the trendline. We have predicted terrific inflation

for US citizens, with the price of oil and gas skyrocketing because of the dollar's drop. This will

be the trend, but the end result will not impact the public before the Earth changes make paper

money worthless altogether.

Iran in particular has threatened to free the sale of their oil from the dollar. This is behind the many

threats the Bush administration makes against Iran, per the Zetas.

ZetaTalk Prediction 3/17/2006: Right on schedule, leading up to the Iran announced date for the

opening of its petroeuro oil bourse on March 20, 2006, the Bush administration is saber rattling

and making threats, implying military action is not off limits and listing Iran as the world's

bogeyman. What do they hope to accomplish? Deflecting a precipitous drop in the dollar, at the

very least. The world has used the dollar in oil trades for decades, due to a Saudi promise to hold

to the dollar. What this does for the US is force countries around the world to retain dollars, as

they need them to buy oil from the primary producers. Iraq slipped to the Euro in the years

preceding the 2003 invasion, but was quickly returned to the dollar in 2003 by the US

administrators who took over the Oil Ministry in Iraq. But the steady slide to slip to the Euro

from the dollar has continued, with Norway, Venezuela, and Syria moving to the Euro of late.

Iran is the 4th largest in oil production, and holds the 3rd largest oil reserves, so securing this

under US occupation has been a goal of the Bush crowd all along. But the timing of the saber

rattling indicates a financial issue as the precipitator.

What happens, then, if the US dollar is no longer desired, because it is no longer needed for the

oil markets? The dollar gets dumped. As it drops in value, as it has been dropping in value, it

does not make financial sense for a country or individual to hold onto dollars. One day a dollar

bill is worth $1.00, and the next worth only $.75 as the trading value of the dollar has dropped.

Who in the financial markets wants to lose money? For those in the US, this means an increased

price for products produced overseas, and this includes oil and gas. Each dollar printed without

proper backing dilutes the worth of every other dollar afloat in the markets. So in addition to the

rising cost of goods from overseas, due to the dropping US dollar, the US public would be

dealing with horrific inflation. To prevent this seemingly inevitable future from emerging, the

Bush administration hopes to intimidate Iran into giving up its oil bourse plans, thereby retaining

the dollar supremacy in the oil markets, and in particular an oil market that China uses. This

ensures China bond buying, which keeps the tenuous US afloat.

But Iran did open their oil bourse and is selling their oil in currency other than the US dollar. The Bush

administration lost this war, and now must contend with the disrespect the Saudi's and other oil

producing countries have for the Bush administration. The result is the high price of oil for the US.

You received this Newsletter because you subscribed to the ZetaTalk Newsletter service. If undesired, you can quickly

Unsubscribe.

|